What do technology giants like Shopify, Apple, and GoDaddy have in common with Chobani, Ben & Jerry’s, Under Armour, and Chipotle? Simple: they all used SBA financing to grow into billion-dollar giants at critical, early stages in their growth. Since the program was launched in 1953, the Small Business Administration has financed at least $1 trillion worth of loans to small businesses, startups, real estate investors, family-owned businesses, and other business types.

As with any business venture, it’s vital to do your homework before diving in. Structuring your application appropriately may improve your chances of obtaining financing. It’s important to familiarize yourself with the Small Business Administration’s eligibility criteria and understanding the acceptable uses of an SBA loan.

What can you use an SBA loan for?

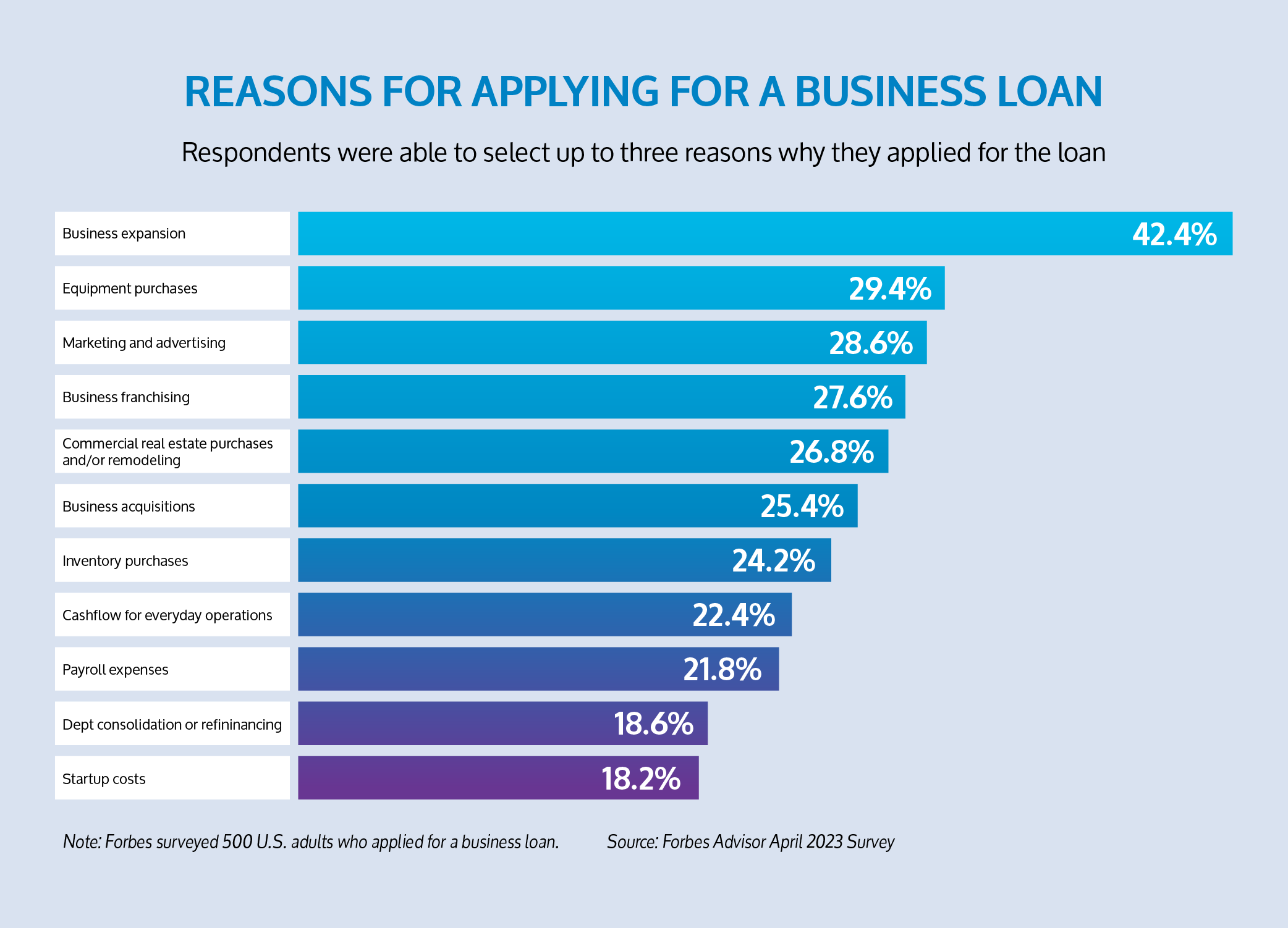

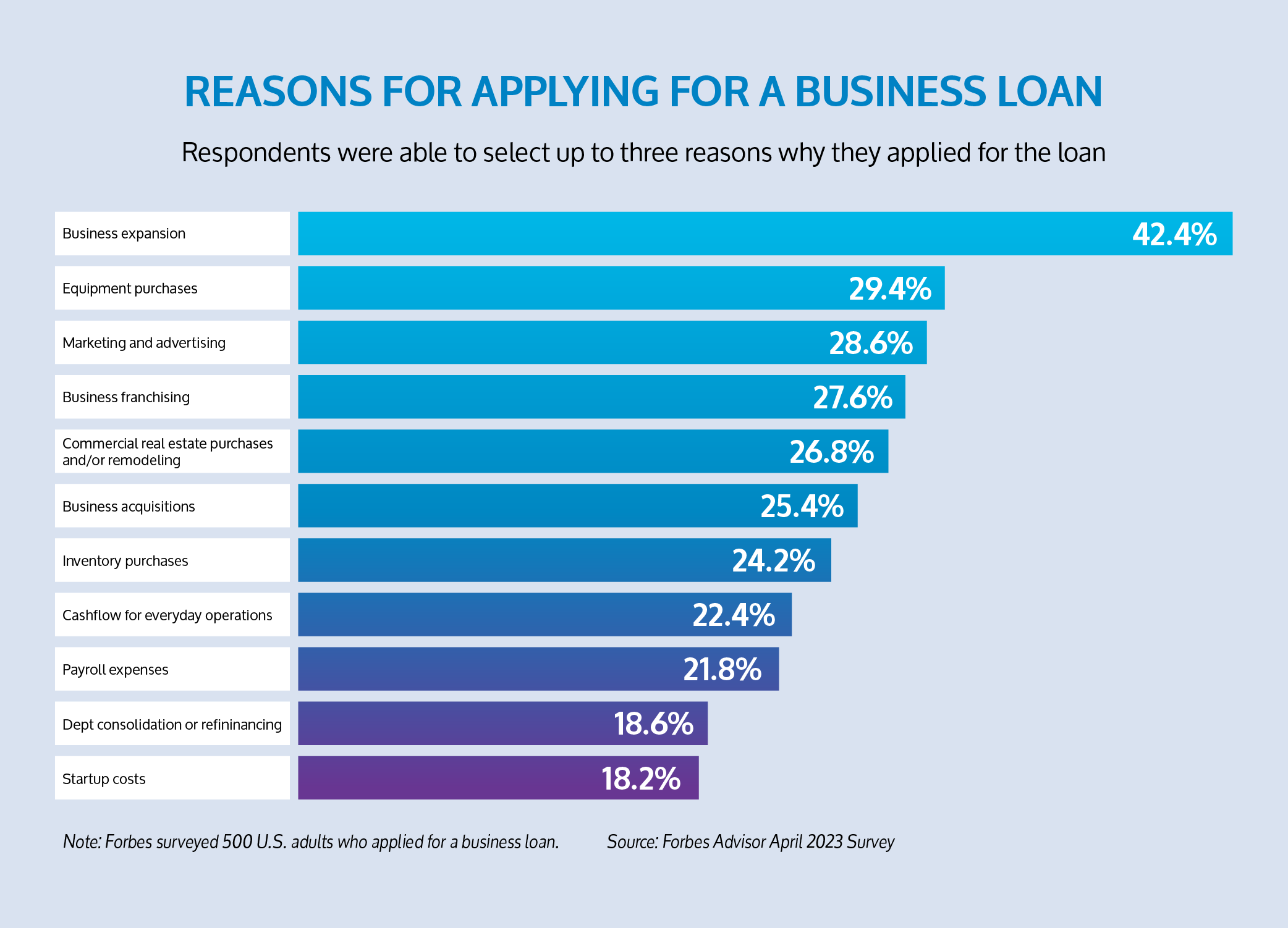

The SBA offers a variety of loan options to help businesses grow, expand, and develop through very flexible terms and conditions. Qualified loan purposes can include real estate purchases, construction, business acquisitions, partner buyouts, inventory, equipment purchases, and working capital.

Here’s a detailed breakdown of what this might mean for your business in practical terms.

- Real Estate: SBA loans are offered to entrepreneurs who are looking to buy, construct, or improve commercial real estate, or purchase heavy equipment. For example, Chobani founder, Hamdi Ulukaya, financed 90% of the $700,000 purchase price for their first facility (a shutdown Kraft Foods plant) with an SBA 504 Commercial Real Estate loan and Ben & Jerry’s financed their third location with SBA funding.

- Partner Buyouts: Buying out a business partner can require significant cash. Once all partners have agreed on the business’ value, you can utilize an SBA 7(a) loan for a lump-sum buyout. Since the SBA’s 2018 update to their acquisition rules, it’s now easier for business owners to buy out their partners. The newer rules state that the borrower does not need to put down any equity provided that the business has a debt-to-net-worth ratio of 9:1 or less. If the ratio is larger than this, the borrower will need to put 10% down to qualify for the loan.

- Business Acquisitions: Similar to a partner buyout, small business owners can use SBA loans when purchasing an existing business, what the SBA refers to as a “change of ownership.” This is permissible when:

- a small business purchases 100% of the ownership interest in another business

- an individual who isn’t already an owner purchases 100% of the ownership interest in the business

- a small business acquires another small business through an asset purchase

- an Employee Stock Ownership Plan (ESOP) or equivalent trust purchases a controlling interest (51% or more) in the employer small business

- Equipment Purchases: Vehicles, machinery, computers, servers, raw input, etc.

- Working Capital: Includes any outlay you make to cover day-to-day expenses, such as salaries and consultancy fees, utilities, training and development, business travel, buying an existing franchise, etc.

- Inventory: Raw materials, semi-finished stock, merchandise and supplies, and finished wholesale purchases (for resale).

Eligibility criteria for different SBA loan types

How do you know if you qualify? And what types of loans can you apply for, judging by your business’s size and revenues?

To be eligible for financial assistance from the SBA, a business must:

- Be an operating business

- Operate for profit

- Be located in the United States or its territories

- Be “small” under SBA size requirements

- Not be a pre-determined ineligible business

- Need to have tried to obtain alternate sources of financing, other than an SBA loan

- Be creditworthy and demonstrate a reasonable ability to repay the loan

For a full breakdown of SBA terms, conditions, eligibility, and interest rates, more information is available on the SBA website.

BankUnited offers SBA7(a), SBA 504 & SBA Express Line of Credit & Term Loans to help you get your ideas off the ground, with options for up to 100% financing. Click here to learn more.

This is not a commitment to lend. All loans are subject to review and credit approval.